Services

11 mins read

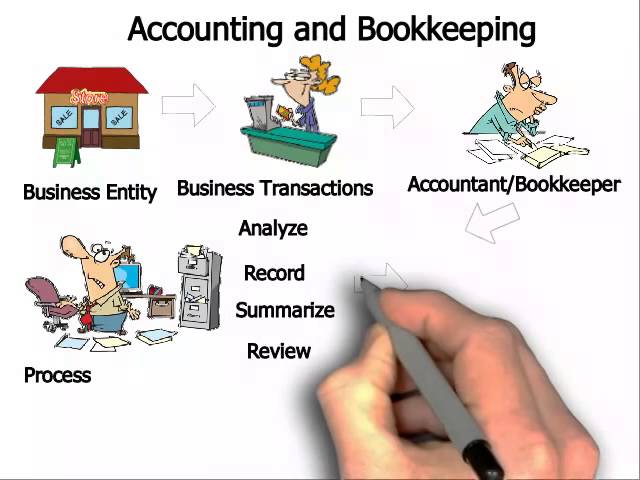

Accounting & Book Keeping

| Accounting is a critical component of a company’s operations. Your business is new or established, it requires a channelized accounting system to grow consistently. |

| Accounting plays vital role in running a successful business. It helps a business owner to maintain detailed track record of the transactions and to analyse the business insights. |

| Also, provides you with financial indicators for the business performance, helps you to compare your projections with the actual results, |

| to make successful short-term and long-term budgeting and supports your business strategy and growth based on historical data. |

| Our qualified accountants at MKS Accounting Services can provide you with tailored accounting solutions that will not only help you being compliant with the regulations, but it will add value to your business. |

| Appointing professional accountants does not serve complete purpose of maintenance of proper books of accounts, as it requires accounting software to record an entity's transactions. |

| Selection of relevant accounting software that is suitable for your business is a key to be cost effective with appropriate chart of accounts, functional integration and data privacy when selecting software solution. |

| Due to the increasing importance of proper recording of business transactions, outsourcing of accounting function is emerging as an integral part for those businesses that cannot afford full time professional accountants or those entrepreneurs who want to rely on a professional services rendering firm with experienced and competent accountant to maintain and supervise their accounting records in compliance with acceptable financial reporting framework and business laws or regulations in UAE. . |

| For newly established businesses, it is essential to maintain records of transactions right from the beginning to avoid future complications in doing accounting reconciliations and non-compliances with statutory record keeping requirements as per the Companies Commercial Laws applicable in mainland and free-zone businesses. |

Business Management Services

| It has become a complicated task to run and manage a business because of the stiff competition in the market. Our wide range of business services includes CFO Services, Cash Flow Management Services, Finalization of Financial Statement, Cost-benefit analysis, and a lot more. |

| It’s a difficult task for business owners to deliver the best services and manage their employees and lead them forward. |

| Since everyone is working towards to reach the top, only better than the best can survive in the business world. |

| MKS accounting services offers top-grade

business services in UAE for those who are planning to set up or expand their

business in the country. * CFO Services * Finalization of financial statements * Cash flow management services * Feasibility Study Services * Due diligence & Business Valuation |

In Country Value Program

| The In-Country Value (ICV) program aims to support the Ministry of Industry and Advanced Technology’s mandate of improving the productivity and sustainability of the UAE’s Industrial sector. |

| The In-Country Value certificate evaluates the contribution of a company to the local economy. |

| Certified suppliers gain advantages during the award of tenders and contracts based on their ICV score. |

| The ICV certificate grants companies the first right of refusal in the tender process. |

| The ICV certificate is hence extremely important for companies that have direct commercial dealings with these (and other) government entities. Supplier companies are required to have a National ICV certificate to participate in procurement tenders of the participating entities. |

| ICV Certificate UAE |

| ICV Certificate is a system generated digitally signed document issued by the Certifying Bodies empanelled by the Ministry of Industry and Advanced Technology (MoIAT). |

| The ICV Certificate shows the ICV score of an entity which represents the contribution of that entity in the economy of UAE and in promoting Emiratisation in the private sector. |

| Objectives: |

| Increase the percentage of national industrial entrepreneurship projects and the proportion of national talent working in this sector to foster sustainable economic growth. |

| Stimulate and attract foreign investments, promoting innovation and knowledge transfer while diversifying the economy. |

| Maximize the percentage of local purchases and contribute to the development of the country's industrial sectors. |

| Enhance the private sector's contribution to the national GDP creating employment opportunities and driving economic prosperity. |

| Improve the business environment within the industrial sector, fostering a culture and innovation, efficiency and competitiveness. |

| How it works: |

| Companies can apply for the national ICV certificate through a newly introduced digital platform that utilizes blockchain technology. The platform features a bidding process, allowing users to select a certifying body. |

| All audited financial statements must be issued by a licensed auditor under the Ministry of Economy, adhering to International Financial Reporting Standards (IFRS). |

| In the case of companies with multiple branches in the same Emirate engaged in identical activities and sharing ownership listed on licenses, a combined ICV certificate will be issued. |

| Audited financial statements should not exceed 2 years from the certification year. For newly established companies (less than 10 months old) lacking audited financial statements, management accounts covering up to 9 months can be used for ICV calculations. Management accounts exceeding 9 months will require auditing. |

| The validity of the ICV certificate is 14 months from the issuance of the Audited Financial Statements or the issuance of new Financial Statements, whichever is earlier. |

| Service providers based in the UAE mainland are automatically granted 10% ICV for calculation purposes. |

| The headcount of employees will be determined based on an average basis per year, not year-end figures. |

| How MKS Accounting Services Stand As an Expert ICV Consultant |

| Our team is experienced in gigantic number of ICV engagements from Top ten and leading regional Accounting Firms, right from the implementation of the ICV Program by ADNOC in March 2018, |

| therefore we are an expert ICV Consultants with required level of knowledge and confidence to deal with any requirement of our clients with respect to arrangement of ICV Certificates |

| Being expert ICV Consultant we are well aware of the updated ICV Guidelines by Ministry of Industry and Advanced Technology (MOIAT) and have sound in-depth cognizance of pertinent dynamics that effect ICV Score in any business environment. |

| In addition to our expert ICV knowledge and experience, we go extra miles with our clients to stand out the competition by performing below activities during our service delivery: |

| Preparing ICV template of our clients by ensuring that all the ICV score gaining areas are included in the template to achieve optimal ICV score that our clients are eligible to in accordance with ICV Guidelines. |

| Making our clients understand about the parameters of ICV score and the determining factors that affect the ICV score in their particular business case. |

| Prepare working files in a way to ensure seamless approval of our client's ICV Certificate. |

| Ensuring that only relevant information is required that have notable effect on the ICV Score of our clients, to avoid unnecessary delays in gathering and verifying information. |

Audit and Assurance

| Audit and assurance service is one of the core services that every business need to track their financial transactions. |

| In the UAE, conducting audits is a fundamental practice to ensure transparency, regulatory compliance, and the integrity of business operations. |

| At MKS Accounting Services, we recognize the significance of audits and offer comprehensive assistance to businesses navigating this process. |

| You can navigate the complexities of auditing in the UAE with confidence. |

| Our commitment to excellence ensures that your audits are conducted efficiently, accurately, and in full compliance with regulatory requirements, enabling you to focus on achieving your business objectives with peace of mind. |

| Our Auditors are ready to assist you in the audit from the planning to reporting of the audit. |

| Audit support Services include: |

| Internal audit |

| External audit |

| Data Analysis |

| Liquidation audit |

| FTA Tax audit Support |

Corporate Tax

| On January 31st, 2022, the Ministry of Finance of the UAE announced the introduction of corporate tax of 9% on business profits which are exceeding AED 375,000 for the financial years starting on or after 1st of June 2023. |

| Corporate Tax is a form of direct tax levied on the net income or profit of businesses. |

| With the upcoming tax regime, it is critical for businesses operating in the UAE to keep sound accounting records and create a tax strategy which is aligned with their short- and long-term goals. |

| Basic Corporate Tax compliances relates to below matters: |

| Registration with Federal Tax Authority (FTA) for Corporate Tax purpose. |

| Filing of Corporate Tax Return either Group or Standalone depending upon Registration, and Tax Payable to FTA within 9 months from the end of the relevant Tax Period. |

| Maintenance of IFRS based financial statements which are required to be audited where Taxable Person deriving revenue exceeding AED 50 million or a Qualifying Free Zone Person. |

| Maintain all records and documents for 7 years following the end of the Tax Period to which they relate. |

| For the purpose of Transfer Pricing, maintain Master file and a local file Files in form specified by the FTA containing information regarding the Taxable Person’s transactions and arrangements with its Related Parties and Connected Persons. |

| Apply Withholding Tax to income specified in a Cabinet decision on gross amount of the payment and remit to the FTA in the form and manner and within the timeline prescribed by the FTA. |

| Corporate tax services include: |

| Corporate tax preparation |

| Corporate tax consultancy |

| Corporate tax compliance |

| Transfer pricing |

Value Added Taxation (VAT) Services

| VAT (Value Added Tax) |

| VAT (Value Added Tax) is a form of an indirect tax that was introduced in the UAE on 1st January 2018. VAT is a transaction-based indirect tax that is levied at each step of the supply chain. End consumers generally bear the VAT cost while registered businesses collect and account for the tax, in a way acting as tax collectors on behalf of the federal tax authority.VAT is used in more than 180 countries around the world. All OECD countries except the US have VAT. |

| It is essential for businesses to understand any obligations they may have under the UAE VAT legislation. The responsibility lies with the business to ensure that any required compliance obligations are fulfilled. |

| To fully comply with the UAE VAT legislations, businesses may need to make some changes to their core operations, financial management, and bookkeeping. It is essential that businesses try to understand the implications of the VAT regulations and make every to align their business model to government reporting and compliance requirements. |

| We ensure that your books of accounts and records are as per relevant VAT laws and advise you regarding optimizing your VAT position. We give you a practical approach about VAT obligations. |

| MKS Accounting Services works with you to understand the whole picture when it comes to tax advice. We take a proactive approach to look after your interest, whether you need help with business, VAT or corporate tax. |

| Our VAT services include: |

| Registration & De- Registration |

| Return filing |

| Advisory |

| VAT Health Checks |

| Refunds |